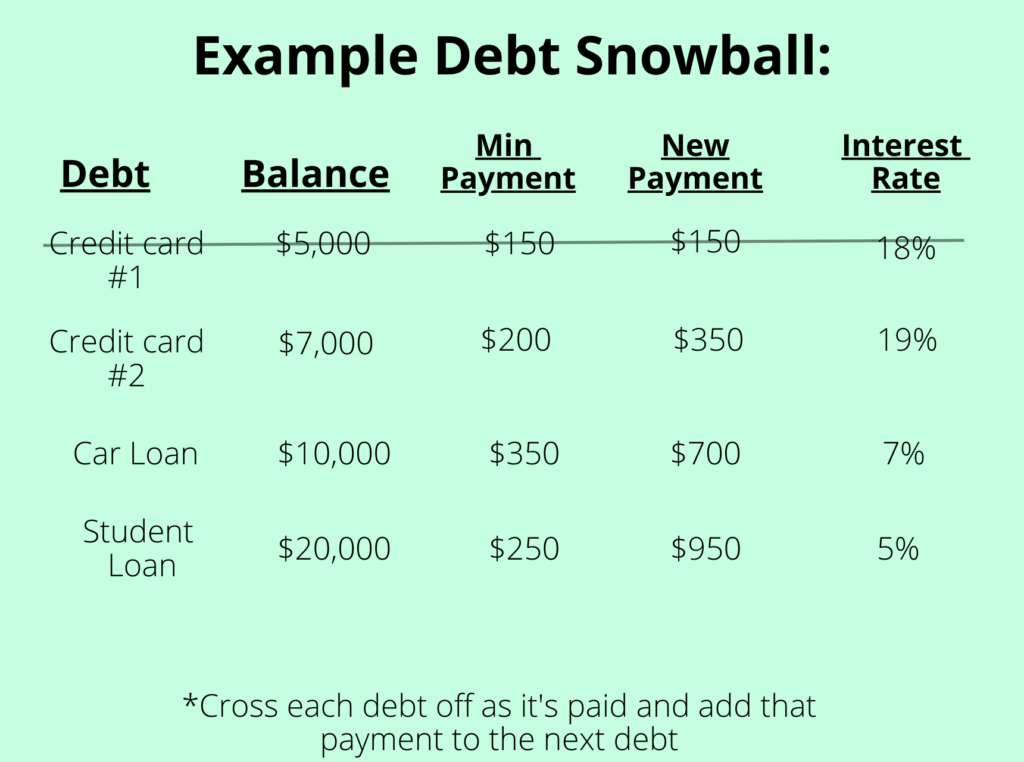

We used the debt snowball method to pay off our debt. You list all of your debts (except the mortgage) in order from smallest balance to largest. Next to the total balance, write down the minimum payment owed. Next, add a column for “new payment.”

This is where the “snowball” effect comes in. Once you’re done paying off the smallest, you automatically wrap that minimum payment amount into the next one, and keep going like this. The idea is that you’re already used to making that payment, and by automatically putting that into the next one, you’ll be paying off extra by default every month now until you reach your last debt.

Tips:

- Use a tracker for motivation

- Pay off even more than the minimums when you can

- Make it a priority to get rid of the debts you no longer want around

- Write your interest rate for each debt on your debt snowball sheet as well

- When you pay one off, call the creditor and schedule your new, automatic minimum payment

Some folks say it’s better to pay the debts with higher interest rates first. I’ve heard the debt snowball method is more effective because you get quicker wins and it’s more motivating, etc. It worked for us but ya know, do it a different way if you think you’ll stick with it better 🤷♀️

Some say don’t prioritize paying off low-interest debt (like student loans). And part of me gets that. If the gov’t does pull through on forgiveness, that’d be cool. I just tend to be skeptical of it. Plus, to me, low interest is still interest and I don’t want debt payments in general.

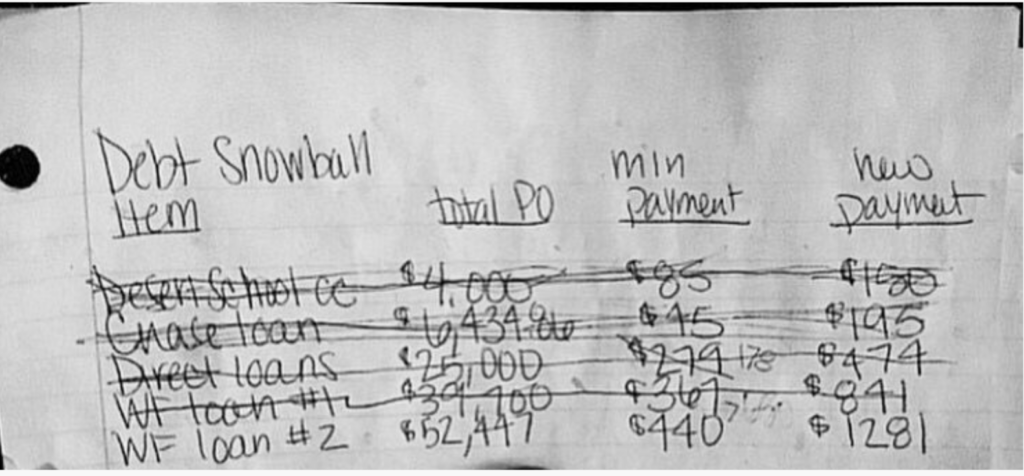

Once we paid off this debt, we freed up roughly $1300 a month in expenses. That’s huge! Getting rid of debt gives you more disposable income to work with in the long run. Here’s a picture of our original debt snowball:

We started this a bit before we got married around 2011 and we paid it off in March 2020. The timeline will be different for everyone depending on what’s going on in your life, your job, and all of that. Some months we put a lot extra on our debt and some months we only paid minimums. Life is always changing and so will the amount that you can pay down.

Do try to stop using debt during the process so you’re not directly working against these efforts.

Click here or follow me on Instagram to read more posts on personal finance.