I’m an avid budgeter. I’ve budgeted every month for the last approximately 10 years. Budgeting has provided me with a sense of control over my finances that I never used to imagine was possible. In this post, I’m sharing the five tools that I use when I budget.

My Last Active Budget

I use the last active budget that we have to pull accurate amounts for my new one.

Example: Last budget period I projected spending $150 on going out to eat. I actually spent $250. What will I plan to budget for in this category for the current period?

My Current Budget Template

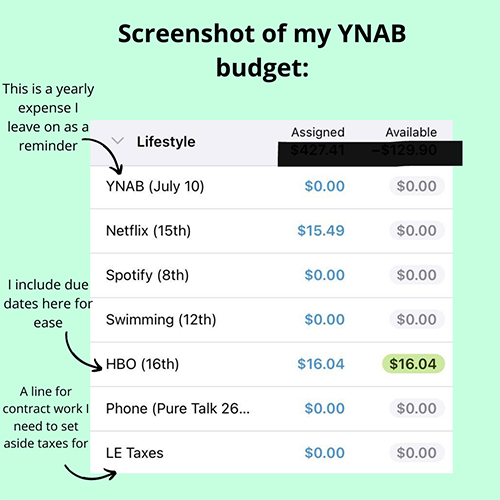

We use YNAB as our budgeting tool. I used EveryDollar prior to this for years until we distanced from the Dave Ramsey brand. I won’t like when I say it’s been a tough switch, but we’ve made this new app work.

YNAB Pros: All my budget categories automatically transfer over to my new template. My bank account is linked to the app and are automatically pulled in, which makes it easy to drag and drop transactions to their proper category within the app.

YNAB Cons: The app feels overcomplicated to me. With budgeting, I’m a firm believer in keeping things as straightforward and simple as possible. And this app just seems like it has a lot going on. I also can’t set up budgets on a 2-week basis, which is how we budget, so I use workarounds to make it fit our own budgeting needs and preferences.

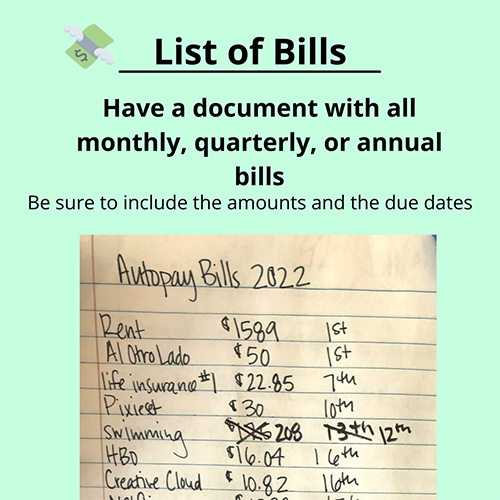

List of Bills

I always have my list of bills handy when I budget. It’s a list of every regular expense that comes out in a month, quarter, or year. Be sure to include the amount that’s due and the due date next to it to save time when budgeting.

Calendar

We budget on a two-week basis. So I look at what’s coming up during that two weeks, such as:

- bills that are due

- who has a birthday, baby shower, etc.

- a car that needs an oil change

- extra income from a side gig

Basically, anything that’s happening during that 2-week timeframe that we need to account for.

Calculator

I use my phone or computer calculator to close out the previous budget and do any other basic math that comes up while we’re budgeting.

And that’s it! The five tools I use to budget.

The more you do it, the easier and more intuitive it gets. Budgets are always changing and evolving. They’re very specific based on the person’s individual style and life situation. A budget isn’t a stagnant document you look at once or twice a year. Your budget adapts to and reflects your life.

I’m almost always happy to help people (for free) with budgeting. So contact me with questions or to set up a session to set one up together! You can also check out my other posts on personal finance here. Happy budgeting! <3